Visitors to Tsim Sha Tsui’s Canton Road aren’t stocking up like they used to (Getty Images)

Hong Kong’s Tsim Sha Tsui slid to the third spot among the world’s most expensive shopping districts this year as economic recovery in the Asian financial hub lagged its global peers, according to a report released this month.

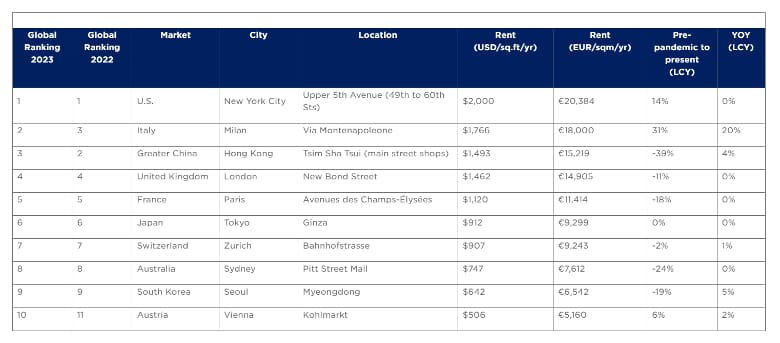

Retail rents in the strip leading down to Victoria Harbour climbed 4 percent in 2023 to an average $1,493 per square foot per year. However, that uptick was not sufficient to match the 20 percent increase along Milan’s Via Montenapoleone, which displaced Tsim Sha Shui from the second-ranked spot it held last year with average rents of $1,766, according to Cushman & Wakefield’s Main Streets Across the World report.

Both cities again came in behind New York’s Fifth Avenue, which maintained the top spot that it had seized from Hong Kong last year, despite rents in the Manhattan hotspot holding steady at $2,000 per square foot per year. Rosanna Tang, head of research for Hong Kong at Cushman & Wakefield, attributed the city’s slide in the rental rankings to visitors shifting their spending to experiences over pricey merchandise.

“The focus of visitors in Hong Kong has shifted from ‘shop till you drop’ to a greater desire for local culture and experience-based touring,” Tang said. “The rise of e-commerce, the strengthened HK$ performance against other currencies, as well as competition from neighbouring GBA (Greater Bay Area) cities, are posing challenges for Hong Kong retailers and mall landlords, spurring them to implement ‘out-of-the-box’ retail solutions to maintain competitiveness.”

Asia’s World City Lags Globally

Within Asia Pacific, Hong Kong still claims an outsized slice of the region’s most expensive locations for leasing shop space, with Tsim Sha Tsui’s top rank in the region followed by Causeway Bay which held onto the second spot in APAC with annual retail rents inching up by 6 percent to $1,374 per square foot this year compared to 2022.

Rosanna Tang, head of research for Hong Kong at Cushman & Wakefield

With office occupancy sliding in Hong Kong’s traditional business hub, Central district slid one spot to rank eighth among retail locations in APAC this year, despite rents climbing 9 percent compared to 2022 to $673 per square foot per year.

Rents in all three locations remain well below pre-pandemic levels, with Tsim Sha Tsui retail rents down 39 percent from pre-COVID rates, Causeway Bay having declined 46 percent, and Central at 40 percent below the boom years.

Compared to other top retail markets globally, Hong Kong saw the slowest post-pandemic rebound in shop rents, according to the C&W report.

The consultancy tied the slow recovery in rents to changes in traveller behaviour. Tang pointed out that shopping spending by overnight and same-day visitors in the first half of 2023 amounted to 55 percent and 18 percent of levels recorded in the same period in 2018, respectively. Since that time luxury brands have also adjusted practices of charging premium rates in their mainland stores, diminishing what was once a booming parallel import trade.

“In response to changing visitors’ preferences, landlords and retailers are advised to rethink their traditional strategies to enhance their existing retail offerings,” said Kevin Lam, executive director and head of retail services for Hong Kong at the property agency. “Experiential retail is here to stay and will continue to be in the driving seat of the new retail industry.

Japan on the Rebound

Japan has experienced a more robust retail recovery than the Greater China region with Tokyo’s Ginza district retaining its spot in the survey as the third most expensive retail location in Asia Pacific despite average rents in the famed strip remaining at $912 per square foot per year.

Four of the world’s 10 most expensive retail destinations are in APAC. (Source: Cushman & Wakefield)

Osaka’s Midosuji shopping strip moved up five spots in the rankings from placing 11th in 2022 to 6th this year following a 60 percent surge in rents to $730 per square foot.

Tokyo’s upscale Omotesando area as well as its Shinjuku business district claimed the fourth and seventh spots in APAC, respectively.

The strength of Japan’s retail sector is also gaining attention from global investors with PGIM Real Estate, an affiliate of US financial giant Prudential, noting in a report this week that the country is leading the region’s rebound in high street retail.

In the market outlook for 2024 the investment manager said it expects Japan’s retail rebound to extend through next year on the back of strong tourist arrivals and spending.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : MingTiandi – https://www.mingtiandi.com/real-estate/research-policy/hong-kong-slips-in-global-retail-rent-rankings-as-recovery-lags/