This Media Briefing covers the latest in media trends for Digiday+ members and is distributed over email every Thursday at 10 a.m. ET. More from the series →

“At this point in time, we’re not prioritizing any specific identifier solution,” said Josje van den Bos, Dentsu’s head of addressable media, who typically works from a global perspective. “Since we tend to work for a large number of really big advertisers, it is key for us to not really exclude or prioritize one over the other, but to offer bespoke solutions where required.”

When narrowing down to particular markets, however, van den Bos said that some identity solutions can have a bit more authority and higher adoption rates. For example, LiveRamp’s RampID has a wider adoption rate out of the universal identifiers in the U.S. among Dentsu’s advertisers and buyers, she said.

From a global perspective, van den Bos said it will take universal adoption and scale to ultimately prioritize one or two alternative identifiers within her agency. Right now, adoption in Europe for any one solution is really low, she said. Therefore, Dentsu is relying on its identity platform, Merkury, to bridge the gap between all of the different identifiers being used. It can accommodate approximately 250 data integrations and, for the time being, allows advertisers to experiment freely with whichever cookie alternatives they see fit.

Zack Sullivan, CRO of U.K.-based Future plc, told Digiday that his team was getting more requests from the buy-side to “implement or scale out” specific cookie alternatives. In the U.S. market in particular – which Future has been working to expand into for the better part of a decade – deterministic identifiers like RampID and UID 2.0 were getting the most engagement because the U.S. advertisers and buyers have a notable fixation on authenticated audiences.

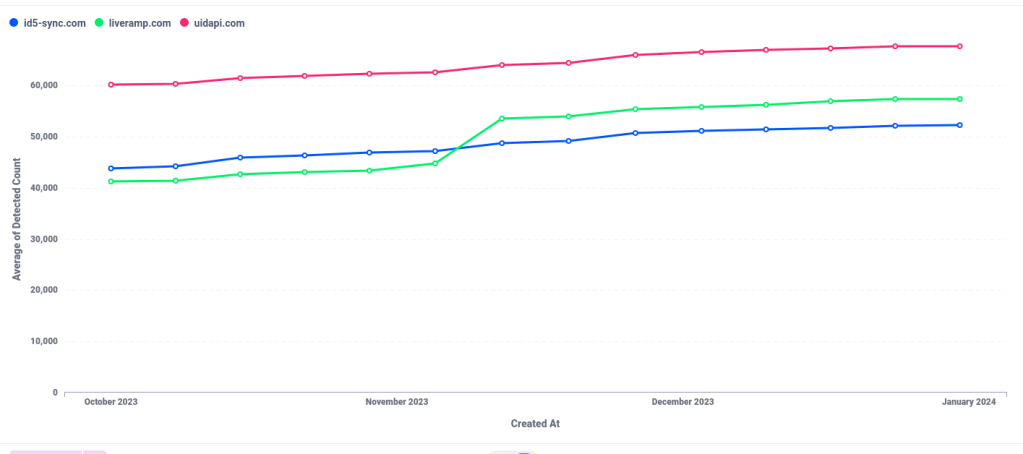

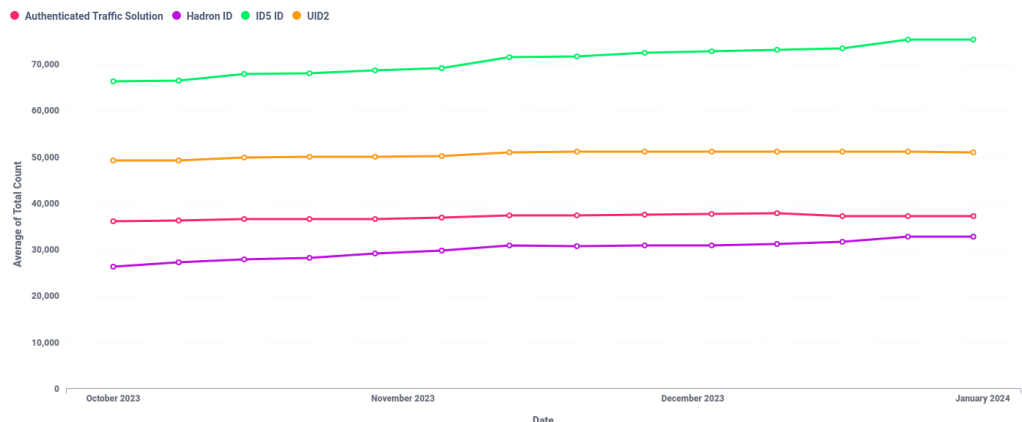

According to Ian Meyers, co-founder of data firm Sincera, which monitors over 300,000 domains, there has been steady growth of “established” cookieless identifiers over the last four months, including ID5, LiveRamp’s Authenticated Traffic Solution, which matches publishers’ first-party audience data with a RampID in real time, and UID 2.0. As of now, more than half of the top 10,000 ad-supported domains that Sincera tracks have integrated some sort of alternative ID in their programmatic businesses, indicating further adoption by publishers.

That said, lesser-known identifiers, like Audigent’s Hadron and 33Across, have also been experiencing an uptick, though they’ve not surpassed the “brand name” IDs, as Meyers called them.

Image description –

Courtesy of Sincera

Image description –

Courtesy of Sincera

Regardless of which audience-based data solution, like deterministic IDs, are being used in a campaign, van den Bos said that’s not the only lever pulled in a media buy. “It will never be the full story. It’s always got to be in place with contextual data, panel data and general audience segments,” she said.

Another agency executive who spoke on the condition of anonymity said that their company is also taking a holistic approach to cookie alternatives, meaning having both a publisher first-party cookie solution, like SharedID or ID5, as well as an authenticated/deterministic ID that uses emails or IP addresses from publisher’s authenticated audiences, like UID 2.0.

In this exec’s case, they’re using SharedID within the agency’s media strategy and ID5 is being evaluated but not currently used. Meanwhile, they are not using UID 2.0 or RampID in lieu of other solutions that were developed in-house, which they said works virtually the same as UID 2.0. But they also said they have concerns at present about how reliable RampID will be in a cookieless environment based on the identifier’s current reliance on third-party cookies. However, their agency uses LiveRamp’s Authenticated Traffic Solution and Amazon’s Transparent Ad Marketplace and uses its proprietary identity solution in those mediums as a means for buying authenticated audiences.

“It’s actually hard to tell just what the RampID is right now because it is a mixture of authenticated traffic and third-party cookies. And it’s majority third-party cookies,” the exec said.

It seems that ultimately the consolidation of alternative IDs within the buy-side will happen once scaled, universal adoption is proven out.

“I personally want to see the UID 2.0 scale because of its interoperability and decentralized nature,” said a media buyer who spoke on the condition of anonymity.

What we’ve heard

“We are a TikTok Shop partner and we’re experimenting there … specifically on our @Recipes brand, we’ve seen some success with selling some very TikTok-like kitchen gadgets and that’s been interesting to watch. I don’t think it’s going to represent a massive revenue opportunity in the short-term, but it’s definitely allowing us to understand that audience a bit more.”

— Chris Anthony, Gallery Media Group’s CRO, on the latest episode of the Digiday Podcast.

Newsrooms on strike

A fresh and devastating wave of layoffs has hit the media industry this month. The Los Angeles Times is letting go of over 20% of its newsroom, Pitchfork has been decimated and folded into GQ and Condé Nast is preparing to shave off 5% of its workforce.

And newsroom unions are fired up.

Mallary Santucci, interim co-president of the Condé Nast Entertainment unit of Condé Union and a culinary producer for Bon Appetit and Epicurious, told Digiday she believes the rise of work stoppages and walkouts across media unions shows company managers how valuable workers are, as publishers have become “top heavy.”

“It feels short-sighted to not understand the value and the talent that exists within your company,” she said. — Sara Guaglione

Here’s a timeline of the most recent actions from media unions:

The Onion Inc.

Date: Jan. 24

Action: Petition delivered

The details: Members of The Onion Inc.’s union (which includes staff from The Onion, The A.V. Club, The Takeout and Deadspin) were joined at the bargaining table by Writers Guild of America representatives to deliver a petition to The Onion’s parent company G/O Media. The petition was signed by about 20 people. On Jan. 12, 97% of members at The Onion Inc.’s 34-person union signed a pledge to strike if they do not reach a contract agreement with G/O Media before their current contract expires on Jan. 31.

Outcome: The union has not reached an agreement on a new contract yet.

Conde Nast

Date: Jan. 23

Action: 24-hour work stoppage and walk out

The details: More than 400 of the over 500 Condé Union members participated in a 24-hour walkout on Tuesday. The goal, according to Santucci, was to express their frustration over recent layoff negotiations and for “regressive bargaining,” when one side offers less than a previous proposal offered (The NewsGuild of New York, which represents Condé Union, filed an unfair labor practice charge at the National Labor Relations Board on Jan. 8 against the company as a result). Picketing began Tuesday morning outside One World Trade Center and Condé Nast’s Los Angeles office, while another rally was held online, Santucci said.

Outcome: Bargaining continues this week.

The Los Angeles Times

Date: Jan. 19

Action: 24-hour work stoppage and walkout

The details: The Los Angeles Times Guild went on a one-day strike in response to an announcement about mass layoffs, which have since affected nearly a quarter of the newsroom. Over 300 members participated in the first newsroom union work stoppage in the publisher’s history.

Outcome: The Guild believes the strike “saved scores of newsroom jobs,” according to a statement. However, 94 members are still facing layoffs.

The Washington Post

Date: Dec. 7

Action: 24-hour work stoppage and walk out

The details: Over 250 Washington Post employees walked off the job and refused to work for a day, protesting the company’s offered buyouts to cut costs and an impasse in contract bargaining with management. The Post reported it was the largest labor protest at the publisher in nearly 50 years. Staffers picketed outside The Post’s downtown offices in Washington, D.C.

Outcome: The Washington Post Guild announced on Dec. 22 that they had reached a tentative agreement on a contract after bargaining for 18 months.

Numbers to know

7: The number of years Erika Ayers Badan served as CEO of Barstool Sports before announcing her resignation last week.

115: The number of employees laid off from The Los Angeles Times this week.

~400: The number of unionized staffers at Condé Nast who participated in a walkout on Monday in protest of upcoming layoffs that would affect about 300 people.

$30 million: The amount of money that The Guardian received from reader donations in the U.S. and Canada over the course of its most recent fiscal year.

88: The percentage of top news outlets in the U.S. that are now blocking AI data collection bots from OpenAI and other generative AI companies on their sites. Meanwhile, right-wing news outlets like NewsMax and Breitbart are permitting them for the most part.

What we’ve covered

How podcast networks are testing AI tools for faster translation, ad sales:

It seems it’s not just big digital publishers like BuzzFeed and BDG looking to generative artificial intelligence tools as ways to streamline their sales process.

Podcast networks, like Acast, iHeartMedia and Spotify, are also testing these tools to increase their outreach to prospective clients, expand the range of shows that fit a buyer’s brief and translate shows into different languages.

Learn more about how podcast networks are implementing AI tools into their business operations here.

Some publishers are starting to see revenue lift from alternative IDs:

If you asked publishers last summer which alternative identifiers presented the most promise for replacing third-party cookies, most would have responded with a fatigued shrug.

But now some are able to quantify the cookie replacements’ revenue impact.

See the lift that some publishers are able to measure from some alternative IDs here.

WTF are private state tokens in Google’s Privacy Sandbox?

Google’s Privacy Sandbox features a proposal for fighting fraudulent traffic called Private State Tokens.

Private State Tokens effectively have sites that are able to authenticate site visitors be the ones to vouch for those visitors’ authenticity so that they can be trusted by other sites.

Watch an explainer video on private state tokens in the Privacy Sandbox here.

What we’re reading

Twitch ends its publisher partnerships:

Live stream video platform Twitch has quietly ended its partnerships with Rolling Stone, Complex, Vice and other publishers, according to Adweek. The publishers had been receiving payments between $1 million and $5 million in exchange for exclusive content for the platform.

Billionaire media owners can’t make the media business work either:

The Los Angeles Times, The Washington Post and Time were all purchased by billionaire business moguls in recent years, but according to a report by The New York Times, even they are struggling to stanch the cash losses. Last year, each of the publications were reported to have lost millions of dollars.

Google News is featuring AI-generated articles:

According to an analysis by 404 Media, articles created by artificial intelligence are being boosted in Google News versus articles written by humans. While Google says it’s goal is to eliminate spam content from Google News, the company does not currently focus on whether or not a story was written by AI or a human. Google Search Liaison, Danny Sullivan, responded that Google is not doing anything to “boost” AI-generated articles in Google News, however.

Sports Illustrated is in a precarious position:

Sports Illustrated announced that a “significant” round of layoffs will be coming, after the brand’s publisher the Arena Group, lost its license to publish the magazine, according to The Wall Street Journal. Arena Group missed its quarterly payment of $3.8 million to SI’s license holder Authentic Brands Group, which may result in the layoffs of most, if not all of SI’s 80 unionized staffers.

G/O Media is reportedly putting its portfolio on sale:

After not finding a buyer for its full stable of media titles, G/O Media is now looking for buyers of the individual brands, according to Adweek.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : DigiDay – https://digiday.com/media/media-briefing-media-buyers-say-they-are-still-open-to-all-alternative-identifiers/?utm_campaign=digidaydis&utm_medium=rss&utm_source=general-rss