This article was contributed to TechCabal by Tosin Eniolorunda.

An indisputable fact – which probably deserves more frequent reiteration – is that family-owned businesses are the heartbeat of the Nigerian economy.

From the local shop selling bread to large factories spanning the country, family-owned businesses of all shapes and sizes significantly impact Nigeria’s economy and society.

It is gratifying to note that there are many thriving examples across Nigeria: FCMB Group – steered by Ladi Balogun and building on his father’s legacy; GiG Group – now under the leadership of Chidi Ajaere, who also took over from his father. And let’s not forget Brila FM, run by Deborah Izamoje, while her father, Larry Izamoje, chairs the parent company.

Beyond major enterprises and conglomerates, outside of the bustling big cities, even more stories thrive in the informal sector. Ibadan-based Alhaja Betterlife is one such success, taking over the food service business from her mother and training two of her children for the future.

Alhaja BetterLife and daughter | Image source: Moneipoint

Alhaja BetterLife and daughter | Image source: Moneipoint

This phenomenon is not restricted to Nigeria. Family-owned businesses are estimated to contribute 70% of global GDP. In Nigeria specifically, family-owned enterprises are resilient because they have to be. They have often weathered several economic and political storms without relying on investors and sometimes even take pay cuts to keep the ship sailing.

While granular figures are hard to come by, 2018 data shows that education and healthcare were Nigeria’s leading family-owned business sectors, generating over $1 billion in revenues. Globally, family enterprises lean towards consumer goods such as food and fashion, with a notable presence in mobility, suggesting that there’s more room for Nigerian family businesses to diversify.

But what does a family business look like? And how does it operate and survive?

Wherever you travel in Nigeria, youngsters are easily found learning how to run businesses from a parent, an uncle or aunt, or another family figure of authority.

For new entrepreneurs, establishing a business in a parent’s trade is an attractive proposition. Having learned from their parents, offspring often build adjacent businesses, either supporting or diversifying the main family business. Such diversification leverages the primary business’s brand reputation and social goodwill to help it thrive. This set-up ensures that when times are tough, the family-based group can support any needy part of the portfolio with proceeds from thriving ones.

Regardless of the sector or company structure, trust is a critical currency for businesses. Family-owned businesses typically benefit from abundant trust both internally and with customers. Studies show that customers are 12% more likely to trust family-owned businesses.

Data also shows that family-owned businesses tend to have more substantial cash flow, which they invest back into the business. This is a crucial factor in their success, as family businesses typically must ensure that the business makes money across generations and has solid cash flow. Business processes must also be watertight to prevent theft or missing funds.

A relentless focus on cash flow and processes is a fantastic base for family-owned businesses seeking expansion. However, what often enables fast-growing enterprises to take the next step is access to capital.

Fortunately, family-owned businesses can — by using technology to meet this need — grow and prosper. Thanks to the growing availability of digital business banking systems providing effective cash flow management and smooth payments, credit histories can be established, making working capital loans possible. The next step for expansion — previously very difficult — now becomes realistic.

The story of Nigerian family-owned businesses is one of resilience, adaptation, and enduring legacy. I’m proud Moniepoint has brought financial security to millions of family-owned businesses nationwide by providing reliable business banking, smooth payments, and cash flow management products – enabling access to working capital loans.

With the proper support, these enterprises can navigate the challenges of the modern world, ensuring their place in Nigeria’s economic history and future prosperity.

—

Tosin Eniolorunda is the Group CEO of Moniepoint Inc. He’s building software tools and payment infrastructure that simplifies how banks, businesses, and people pay, collect, grow, and manage money to facilitate happiness for humanity.

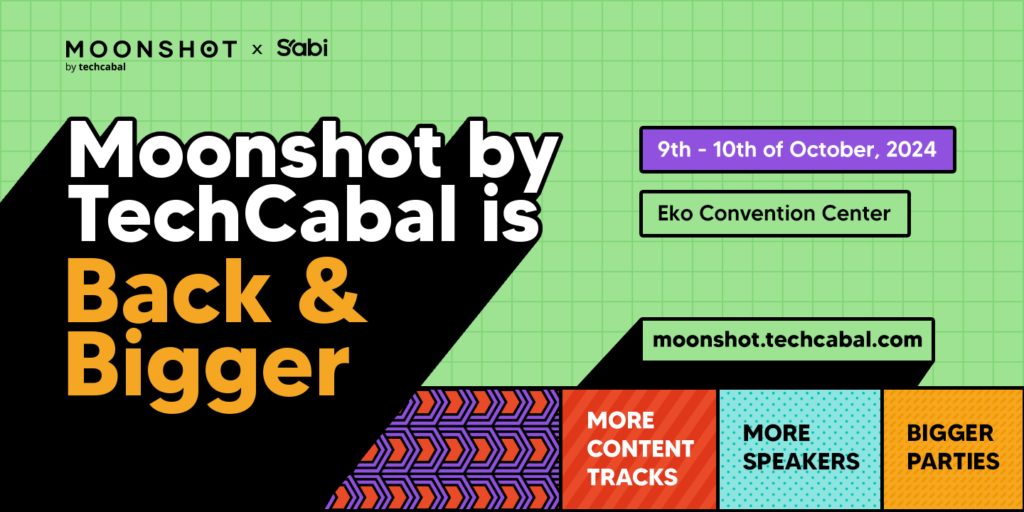

Have you got your early-bird tickets to the Moonshot Conference? Click this link to grab ’em and check out our fast-growing list of speakers coming to the conference!

Get the best African tech newsletters in your inbox

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : TechCabal – https://techcabal.com/2024/07/01/the-importance-of-enabling-nigerian-family-owned-businesses-to-grow/