For the rollout of Ayra Starr’s album ‘The Year I Turned 21,’ her record label Mavin made an unusual marketing choice: adverts on the food delivery app Chowdeck.

“[Mavin] was looking to raise as much awareness for the album as possible,” one person close to the label told TechCabal. “A lot of young people will spend the last of their funds to buy food online and Chowdeck is the most popular [destination.]”

Fintechs like Yellow Card and Cenoa have also advertised on Chowdeck, showing that food delivery apps, whose users are typically young and tech-savvy, offer high-quality leads for advertisers. One fintech executive who has previously advertised on the platform described Chowdeck’s users as a “premium target audience.”

Feedback like that is driving the development of a “proper ad product,” said one person familiar with the matter. The conversation around a core ad product is still in the early stages, and until then, sales staff are expected to continue pitching the existing ad offering to clients.

Chowdeck declined requests for comments from TechCabal.

In 2023, Chowdeck charged ₦4 million to send push notifications (PN) to its 200,000 users, according to a rate card seen by TechCabal. Having grown its monthly users, those rates have likely increased. Other advertisement options include SMS, in-app banners, blog content, social media posts, and offline marketing such as branded rider t-shirts.

“[Adverts on food delivery platforms] work in the same way as advertising with media companies that produce content,” Bolaji Anifowese, Head of partner marketing at Distrobird, a sales automation startup, told TechCabal.

Like media platforms, the apps take advantage of every surface on their app or web platform to grab the users’ attention. The only difference is food delivery apps immediately have the attention of users looking to spend money. It’s the competitive edge that food delivery apps have over other media advertisers.

For years, e-commerce platforms offered in-app advertisements to make extra revenue with comparatively little operating cost. Jumia, which previously boasted of quadrupling the sales of global consumer brand Reckitt Benckiser, on its platform, in one year, charges ₦15,000 for 37,500 impressions on 10 sponsored products.

These ad placements have been limited to sellers and brands on the platform—restaurants and malls in the case of food delivery apps like Chowdeck.

In emerging markets like Indonesia, leading food delivery platforms like Grab and GoFood hosted in the super app Gojek, offer ad placements. In more mature markets, food delivery platforms have reported that their ad revenues contribute significantly to revenue.

If Nigerian food delivery startups ramp up their in-app advertising to get a slice of the in-app advertising market projected to grow to $144.2 million in 2028, there is a risk of bombarding and consequently irritating those who simply want to buy food.

“The balance may be in ensuring that [Chowdeck] does not place the ad in ways that seem intrusive for the users,” Anifowese told TechCabal.

Well, only a few people would mind eating their amala or rice with a handful of ads if the adverts come with discount codes, as some already do, that make the food cheaper.

*Additional reporting by Emmanuel Nwosu.

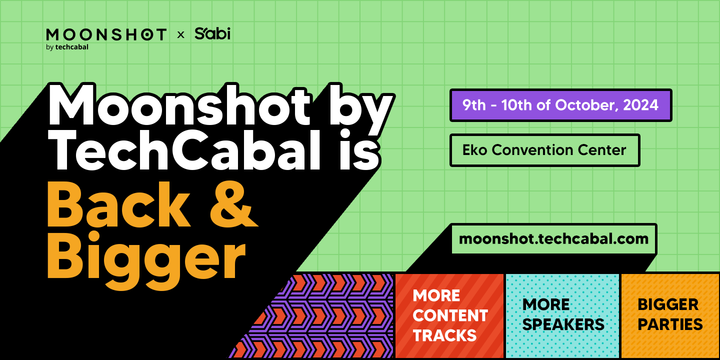

Have you got your early-bird tickets to the Moonshot Conference? Click this link to grab ’em and check out our fast-growing list of speakers coming to the conference!

Get the best African tech newsletters in your inbox

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : TechCabal – https://techcabal.com/2024/07/16/chowdeck-ad-product/