In a stark assessment of the current global economic landscape, the International Monetary Fund (IMF) has warned that the ongoing trade tensions initiated during the Trump administration are contributing to a troubling deterioration in both the U.S. and global economic outlook. As countries grapple with escalating tariffs and trade barriers, the IMF’s latest report highlights the far-reaching consequences of this trade war, suggesting that the implications are not confined to the United States. With economic growth forecasts being revised downward, policymakers and economists alike are called to account for the ripple effects of protective measures and retaliatory strategies that have significantly altered the dynamics of international commerce. In this article, we delve into the IMF’s findings and explore how these trade conflicts are reshaping the global economy.

US Economic Growth Stalls Amid Increased Trade Tensions and Tariffs

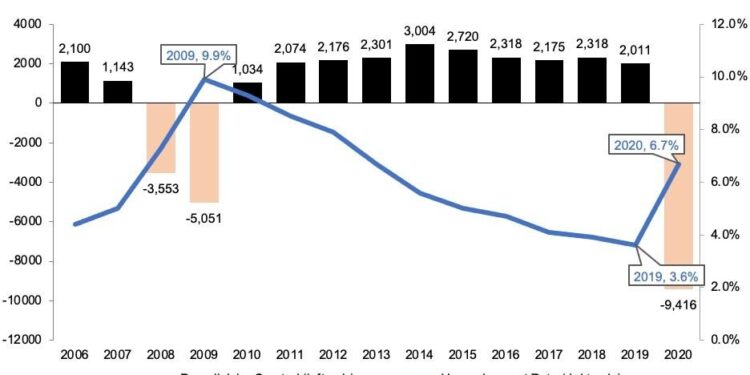

Recent analyses reveal that the ongoing trade war, coupled with escalating tariffs, is putting a significant damper on both domestic and global economic growth. The International Monetary Fund (IMF) has pointed to a constellation of factors contributing to this stagnation, including decreased consumer confidence and weakened investment flows. Key economic indicators have shown alarming trends, notably:

- GDP Growth Decline: A noticeable reduction in GDP growth forecasts prompts concerns about the overall economic health.

- Manufacturing Sector Contraction: Evidence of shrinking manufacturing output highlights the adverse effects of heightened trade barriers.

- Export Challenges: Increased tariffs have made U.S. goods less competitive abroad, dampening export performance.

In a recently published report, the IMF emphasized the critical need for dialogue and resolution to mitigate the prolonged effects of trade hostilities. According to their findings, businesses are becoming increasingly hesitant to commit to new projects, focusing instead on the uncertainty posed by trade negotiations. The outlook for economies globally reflects this sentiment, as fears of a broader recession loom. The data supporting these trends are stark:

| Indicator | 2019 (Pre-Trade War) | 2023 (Projected) |

|---|---|---|

| GDP Growth Rate | 2.3% | 1.1% |

| Manufacturing PMI | 52.6 | 46.8 |

| Export Growth Rate | 4.0% | 1.5% |

Global Markets React to Prolonged Uncertainty as IMF Adjusts Forecasts

Global markets have been in a state of flux as the repercussions of the ongoing trade conflict ripple across various sectors. Investors remain on edge, with economic forecasts exhibiting a marked decline, particularly after the International Monetary Fund (IMF) revised its predictions for growth. This uncertainty has led to fluctuating stock prices, diminished consumer confidence, and a general sense of trepidation among businesses. Key indicators suggest a broad trend of reduced spending and heightened caution, with analysts predicting potential ripple effects from decreased investment in emerging markets.

In light of these developments, the anticipated impact on major economies remains significant. In response to the troubling forecasts, many central banks are reevaluating their monetary policies, some considering interest rate cuts to stimulate growth amidst stagnant trade. The IMF’s adjustment of its economic outlook emphasizes a few critical areas of concern:

- Heightened trade tensions: resulting in slowdowns in manufacturing and export-driven sectors.

- Supply chain disruptions: causing delays and increased costs for businesses across regions.

- Global growth projections: facing downward revisions amid rising geopolitical risks.

These shifts have left market participants grappling with the realities of a complex global economic landscape, as uncertainties continue to loom large.

Strategic Recommendations for Policymakers to Mitigate Trade War Impacts

In light of the escalating trade war and its implications for both the US and global economies, policymakers must adopt a multifaceted approach to mitigate adverse effects. Firstly, fostering international collaboration is essential; nations should engage in dialogues to seek diplomatic resolutions to trade tensions. Secondly, enhancing domestic industries through investments in innovation and infrastructure will bolster resilience against external shocks. Policymakers ought to prioritize skills development and workforce training programs to prepare workers for emerging sectors affected by shifting trade dynamics.

Moreover, leveraging data-driven strategies will enable governments to anticipate market fluctuations more effectively. Key recommendations include:

- Establishing trade adjustment assistance programs for sectors and communities most impacted by tariffs.

- Encouraging diversification of trade partnerships to reduce dependency on high-risk markets.

- Implementing tax incentives for businesses that focus on domestic production.

By adopting these strategies, policymakers can create a more stable economic environment that mitigates the risks associated with ongoing trade tensions.

Insights and Conclusions

the International Monetary Fund’s latest assessment underscores the growing concerns surrounding the economic ramifications of the ongoing trade disputes initiated during the Trump administration. As tensions escalate and tariffs remain in place, both the U.S. and global economies face increasing headwinds that threaten growth and stability. Policymakers are urged to consider collaborative measures to mitigate the adverse effects of these trade wars and foster a more conducive environment for international commerce. With global interconnectedness at stake, the resolution of these trade conflicts will be critical to ensuring economic resilience in the coming years. As we move forward, the call for diplomatic engagement and strategic dialogue remains essential in navigating these turbulent economic waters.