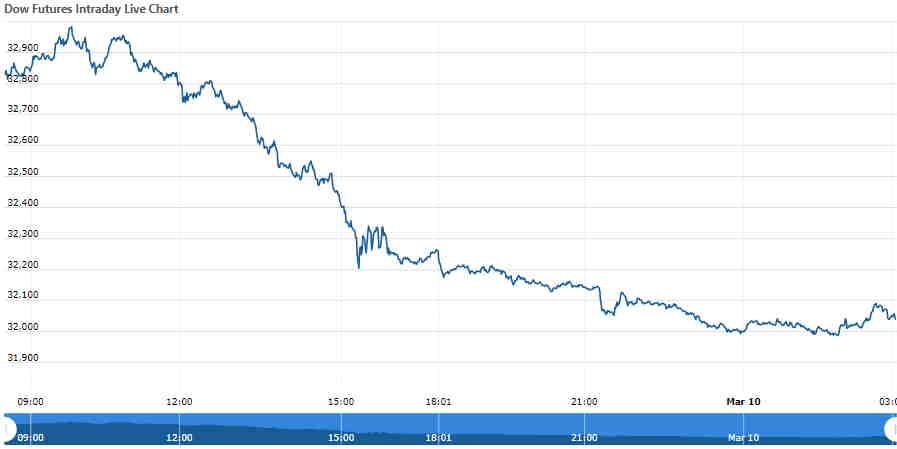

Dow futures reversed course Wednesday morning, climbing higher after a sharp sell-off earlier in the session, as renewed concerns over a potential recession rattled Wall Street. Investors, shaken from recent optimism about a resilient economy, reacted to mounting economic data and hawkish signals from the Federal Reserve that reignited fears of slowing growth. The sudden shift underscores the fragility of market sentiment amid ongoing uncertainty about inflation, interest rates, and global economic pressures.

Dow Futures Stage Rally Amid Renewed Recession Concerns Stirring Market Volatility

Wall Street experienced a sharp jolt Tuesday as worries over an impending economic downturn gripped investor sentiment, prompting a reversal in Dow futures that had been languishing. After a period of optimism driven by strong corporate earnings and global stimulus hopes, the market’s grip on growth narratives has loosened, replaced by growing fears that inflation pressures and tightening monetary policy could send the economy into contraction. This pivot has injected fresh volatility into the trading session, with investors recalibrating their portfolios in response to heightened uncertainty.

Key factors contributing to the renewed market unease include:

- Rising U.S. Treasury yields signaling tighter financial conditions

- Mixed economic data highlighting slowing consumer spending

- Escalating geopolitical tensions undermining global trade confidence

- Central banks emphasizing caution amid persistent inflation risks

| Indicator | Previous Value | Current Value |

|---|---|---|

| 10-Year Treasury Yield | 3.45% | 3.62% |

| Consumer Confidence Index | 108.5 | 98.3 |

| Dow Futures | -150 | +85 |

Wall Street Grapples with Economic Reality After Optimistic Surges Face Correction

After weeks of soaring optimism, Wall Street faces a stark recalibration as recession concerns shake investor confidence. Dow futures, initially sliding, reversed course amid fresh data and hawkish commentary from Federal Reserve officials indicating a longer battle against inflation than previously anticipated. Market participants now increasingly weigh the risks of a slowdown against the resilience exhibited earlier this year, leading to volatile trading patterns and a cautious stance across sectors.

Key factors influencing the market shift include:

- Rising bond yields signaling higher borrowing costs and tightening financial conditions

- Softening consumer spending data pointing to potential demand erosion

- Corporate earnings reports that, while strong, carry warnings about upcoming quarters

| Indicator | Latest Reading | Market Reaction |

|---|---|---|

| 10-Year Treasury Yield | 4.12% | Increased volatility |

| Consumer Confidence Index | 95.4 (Down from 103.2) | Investor caution |

| S&P 500 Earnings Growth | +6.8% | Positive but tempered |

Investors Urged to Prioritize Risk Management as Growth Prospects Show Signs of Strain

Market volatility has surged as economic indicators flash warning signs, prompting investors to reassess their portfolios amid growing uncertainties. The initial optimism surrounding a sustained, gravity-defying economic expansion has given way to caution, with experts emphasizing the need to diversify holdings and maintain liquidity buffers. The confluence of inflation pressures, tightening monetary policies, and geopolitical tensions has heightened the probability of near-term shocks, urging a more disciplined and vigilant approach to capital allocation.

Financial strategists now highlight key risk management practices that could mitigate potential losses in an unpredictable environment. These include:

- Regular stress-testing of investment portfolios against different recession scenarios

- Rebalancing to reduce exposure to overvalued sectors and assets

- Integrating alternative assets such as gold or Treasury bonds as safe havens

- Leveraging hedging instruments to protect downside risk in equity positions

| Risk Factor | Potential Impact | Recommended Action |

|---|---|---|

| Inflation Surge | Reduced purchasing power, higher costs | Increase inflation-protected assets |

| Monetary Tightening | Rising borrowing costs, slowing growth | Shift to short-duration bonds |

| Geopolitical Risks | Market disruptions, supply chain issues | Diversify international exposure |

The Conclusion

As Dow futures climbed higher following a sharp retreat, Wall Street remains on edge amid mounting concerns of an impending recession. Investors are recalibrating expectations, moving away from the optimism of a gravity-defying economy toward a more cautious stance. Market watchers will be closely monitoring incoming economic data and central bank signals in the coming days for clearer direction in an increasingly uncertain environment.