The latest economic forecast from Deloitte offers a comprehensive outlook on the United States economy for the third quarter of 2025. As businesses and policymakers navigate a complex landscape of evolving market trends, inflationary pressures, and shifting consumer behavior, Deloitte’s analysis provides critical insights into the factors expected to shape the economic trajectory in the coming months. This report highlights key indicators, including GDP growth projections, employment trends, and sector-specific performance, delivering a data-driven perspective vital for stakeholders seeking to understand the challenges and opportunities ahead.

United States Economic Growth Outlook Amid Global Uncertainty

Despite ongoing global economic challenges such as geopolitical tensions and fluctuating supply chains, the United States is projected to maintain a moderate growth trajectory through Q3 2025. Consumer spending remains a critical driver, supported by a resilient labor market and wage growth, although inflationary pressures could temper enthusiasm. Investment in technology and infrastructure is expected to bolster productivity gains, balancing out softer demand in export markets. Policymakers will closely monitor these developments, aiming to sustain momentum without triggering overheating risks. Key uncertainties include evolving trade relations and potential shifts in monetary policy.

The forecast highlights several factors shaping the economic landscape:

- Robust employment figures sustaining household income

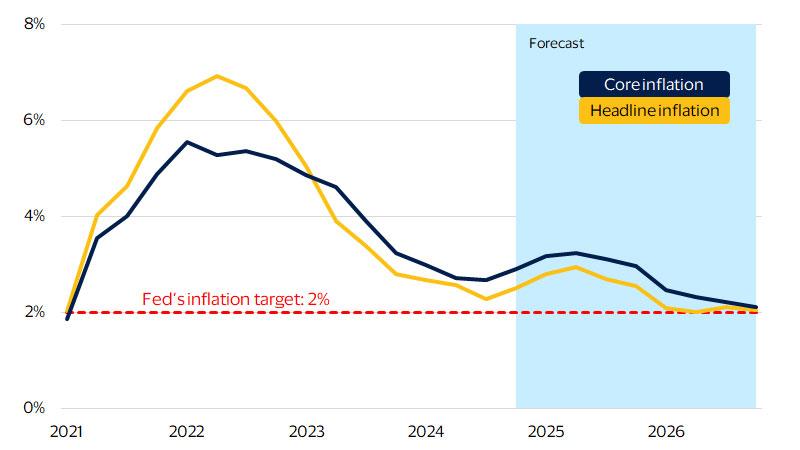

- Moderate inflation rates easing cost pressures for businesses

- Expansion in renewable energy sectors driving new investment

- Volatility in commodity prices influencing manufacturing costs

| Indicator | Q3 2024 | Q3 2025 Forecast | Change (%) |

|---|---|---|---|

| GDP Growth | 2.1% | 1.8% | -0.3 |

| Inflation Rate | 3.2% | 2.6% | -0.6 |

| Unemployment Rate | 3.7% | 3.5% | -0.2 |

| Consumer Confidence | 98 | 102 | +4 |

Key Drivers Shaping Consumer Spending and Business Investment

Consumer spending continues to be propelled by a combination of rising wage growth and shifting demographic preferences, with younger generations prioritizing technology-driven services and sustainability-focused products. E-commerce penetration remains exceptionally strong, supported by innovations in payment systems and last-mile delivery, further boosting retail sales. However, rising interest rates and inflationary pressures pose potential headwinds, compelling households to recalibrate discretionary expenses and increase savings, signaling a cautious but resilient consumer outlook.

Business investment shows a marked emphasis on digital transformation and green technologies, as companies adapt to evolving regulatory landscapes and competitive dynamics. Capital expenditures are increasingly directed toward automation, AI integration, and renewable energy projects, reflecting an accelerated pivot toward efficiency and environmental stewardship. The following table highlights key sectors with the strongest projected investment growth for Q3 2025:

| Sector | Investment Growth (%) | Primary Driver |

|---|---|---|

| Technology & AI | 12.5 | Automation & Data Analytics |

| Renewable Energy | 9.7 | Regulatory Incentives |

| Healthcare | 7.8 | Digital Health Expansion |

| Manufacturing | 6.1 | Supply Chain Resilience |

Strategic Recommendations for Navigating Market Volatility in 2025

Amidst the unpredictable fluctuations shaping the economic landscape in 2025, businesses must adopt agile approaches to protect and grow their market positions. Prioritizing flexibility in investment strategies enables firms to respond swiftly to sudden shifts in consumer behavior and supply chain disruptions. Key tactics include:

- Diversifying asset portfolios to mitigate concentration risks

- Leveraging advanced data analytics for real-time market insights

- Investing in digital transformation to enhance operational resilience

Moreover, companies should intensify focus on scenario planning to anticipate potential downturns and identify new growth avenues. Strengthening stakeholder communication and transparency builds trust during turbulent periods, which is critical for sustained business continuity. The following table highlights comparative risk management priorities across different sectors in Q3 2025:

| Sector | Primary Risk Focus | Recommended Action |

|---|---|---|

| Technology | Cybersecurity | Increase cloud security investments |

| Manufacturing | Supply Chain Disruption | Expand supplier base globally |

| Financial Services | Interest Rate Volatility | Adopt dynamic hedging strategies |

| Retail | Consumer Spending Fluctuations | Enhance omnichannel engagement |

In Summary

As the United States heads into the third quarter of 2025, Deloitte’s economic forecast underscores a period of cautious optimism amid evolving global and domestic challenges. While indicators point to steady growth driven by resilient consumer spending and technological innovation, uncertainties surrounding inflation and geopolitical tensions remain key variables to watch. Stakeholders across sectors will need to navigate this complex landscape with agility and strategic foresight. Deloitte’s comprehensive analysis provides valuable insights for policymakers, investors, and businesses preparing for the months ahead in an ever-changing economic environment.