If President Joe Biden cares about recent college graduates—not just as a voting bloc to be manipulated in hopes of boosting his deteriorating reelection prospects, but as real people with their lives ahead of them—he has to level with them. The truth is that the 12-month on-ramp to student loan repayment will end on September 30, 2024. And nothing is going to change that fact.

But many holders of student loan debt are understandably confused about their obligations. That is almost certainly the intention of the Biden administration, and it callously risks the futures of millions of young Americans.

To arrest his electoral freefall, the president knows he must solidify his support among Democrats, 48 percent of whom hold college degrees (as opposed to 38 percent of Americans as a whole). He must also score a repeat of the youth vote this November. In 2020, 65 percent of voters aged 18 to 24 voted for Biden, more than any other age segment. By 2022, the Biden administration thought it had found the key for a repeat performance when it announced that it was essentially converting the COVID-era repayment suspension into a program to cancel or reduce $430 billion of federal student loans.

In June, the plan to erase up to $20,000 in student loan debt for Americans making less than $125,000 was struck down by the Supreme Court in a 6-3 decision. In the case, Biden v. Nebraska, the Court ruled that the Biden administration had exceeded its authority in implementing the program. According to Justice John Roberts in the majority opinion, “the question here is not whether something should be done; it is who has the authority to do it.” In other words, the plan to transform the student loan program in a debt cancelation scheme would require legislation by Congress.

But to a president who warns us that democracy itself is under threat, the final word from the highest Court in the land is apparently not enough. Stating that “the Supreme Court blocked it. But that didn’t stop me,” Biden announced in February that by his own authority, he is canceling $1.2 billion in federal student debt for 153,000 borrowers. “Congratulations—all or a portion of your federal student loans will be forgiven because you qualify for early loan forgiveness under my Administration’s SAVE Plan,” reads an election-year email from the Department of Education bearing Biden’s signature.

What that email should have stated is that the executive actions to cancel student debt for all but a few have failed and that there is no legal path to implement a plan for blanket loan forgiveness. In fact, the president has a moral responsibility to take to the bully pulpit to articulate clearly, loudly, and often that borrowers need to be fully aware that they must be proactive in arranging to resume their student loan payments.

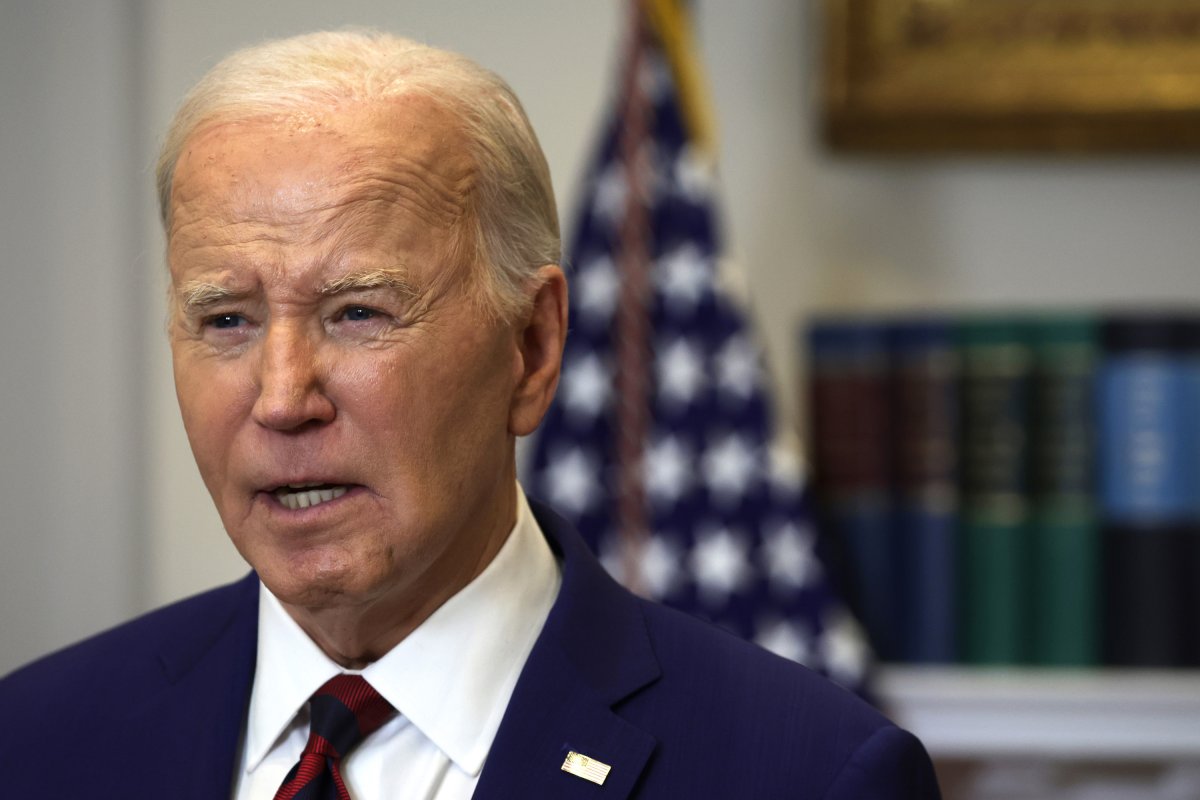

WASHINGTON, DC – MARCH 26: U.S. President Joe Biden delivers remarks on the collapse of Francis Scott Key Bridge in Baltimore, Maryland, in the Roosevelt Room of the White House on March 26, 2024 in…

Alex Wong/Getty Images

Monthly payment obligations that were paused during the pandemic resumed in October 2023. Yet by mid-November, around 40 percent of borrowers had not made a payment on their loans, reflecting persisting confusion. It’s time for the administration to clearly and unambiguously communicate that failing to proactively restart student loan payments will invite dark clouds to follow otherwise promising lives for a very long time.

Failing to make student loan payments can have a serious negative impact on borrowers’ credit score. Qualifying for a credit card, car loan, or even obtaining approval for an apartment lease are nearly impossible with low credit scores. And rebuilding credit can be a years-long process.

Borrowers who fail to make payments and default on their student loans will see the balance of their loans and any interest owed immediately due. Upon defaulting, borrowers lose their eligibility for additional federal student aid and may have their wages garnished and tax refunds withheld. Borrowers who default may face litigation and collections, which brings associated court costs, collection fees, and other unwelcome trouble. They may also find themselves unable to purchase or sell real estate.

The grace period for getting back on track with student loan payments ends in September. But the president and his administration continue to brag about student debt cancellation, misleading some borrowers to think that loan forgiveness is just over the horizon.

America’s young people need the truth about their student loans today, Mr. President. Keeping the charade going until after the election puts their future at risk.

Karen Harned is the President of Harned Strategies.

The views expressed in this article are the writer’s own.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : Newsweek – https://www.newsweek.com/president-biden-owes-student-loan-borrowers-some-honesty-opinion-1884558